(*Linked or embedded content may have been removed or be unavailable.)

International expansion: It’s a cornerstone common to many ambitious growth strategies. But without the right partners in your corner, it can also be fraught with unexpected vulnerabilities.

Many brands have learned that to their cost. And expansion into the Asia-Pacific (APAC) region is no different. With the region’s growth strengthened throughout 2023 and holding strong during 2024, it’s caught international brands’ eyes as they plot expansion opportunities. But as the marketing news platform The Drum points out, businesses who enter the market without an airtight localization plan do so at their peril.

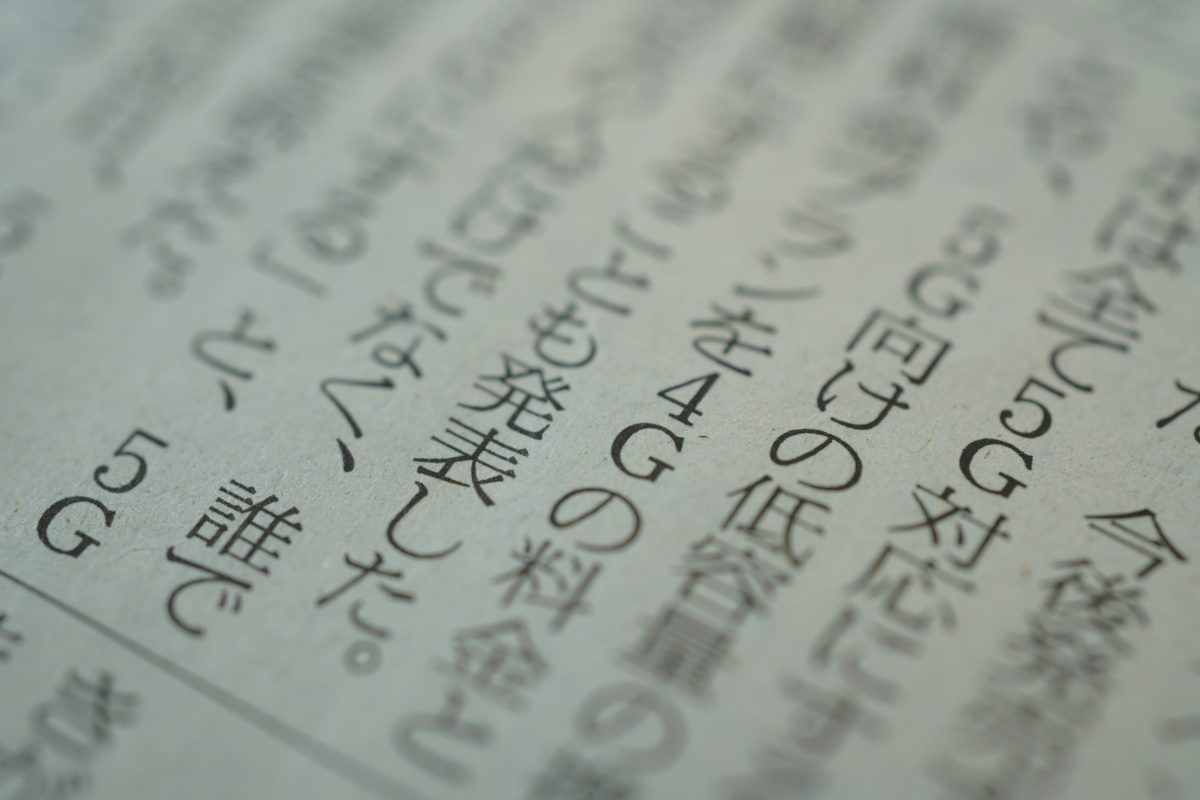

“Once, simple translation was seen as enough for brands deploying in new markets,” Nan Su of The Drum wrote. “But as customer expectations rise globally, straightforward translation won’t pass muster.”

Supporting Su’s thesis is the Croud International Localization Report, which surveyed 1,600 consumers across China, Japan, France, and Germany. The takeaway? Without a localization strategy informed by real expertise that establishes a blueprint for authentic and engaging international content, brands risk alienating their target consumers and hobbling themselves right out of the gate. And that means understanding local consumers’ expectations — insights that specialized localization professionals can bring to the table.

“Tactics that work successfully in a European environment aren’t guaranteed to provide the same results when applied to APAC audiences,” Su wrote. “Our research found that French and German consumers prioritize correct links to social accounts and local imagery. Chinese and Japanese audiences, in comparison, place more emphasis on website loading speeds and native currency usage.”

That’s good advice for retail and ecommerce businesses with extensive assets to be localized. But it also affects other industries like travel. Caesar Indra of Traveloka, who has seen a surge in traffic to Southeast Asia, observed on CNBC that understanding local consumers’ preferences, sensibilities, and common behaviors is key to their success. And those are insights that go beyond simple translation.

“Localization has been a central theme of our strategy,” he said. “What’s important to us is investing in the right features and relevant offers to serve these customers better.”

It’s business wisdom that PepsiCo wielded to their advantage: meet the consumer where they’re at. For example, according to FoodNavigator Asia, the company found that their Quaker sales in China were just 10% of the much smaller Hong Kong market. The reason was simple: Chinese consumers have more breakfast options available to them. To make their products more competitive, they embraced local consumers’ palates by offering softer oats. They also learned that Chinese consumers expect products like oatmeal to be called porridge — another change that paid dividends.

“Simply changing the naming according to local habits seemed to make oat porridge a good contender in many categories,” PepsiCo told FoodNavigator Asia.

There’s no uniform blueprint for a successful APAC launch. But that’s where localization professionals come in. Equipped with highly specialized knowledge, they bring a keen eye for identifying specific strengths and opportunities when entering new markets. “Brands that develop localized campaigns and modify their behavior and operations accordingly are poised to succeed,” Su wrote for The Drum. “This is an ongoing process; markets are constantly shifting and you must adapt to these changes.”

When consulting on localization, don’t just focus on language and translation, be prepared to go deeper and ask about broader cultural concerns and preferences such as local customs and preferred payment methods. Well established Language service providers have real-world connections to the markets you want to enter, and possess a wealth of knowledge, experience, and resources that can be put to work for you.