(*Linked or embedded content may have been removed or be unavailable.)

Part Two: Netflix

While Amazon Prime is unique in its hybrid streaming and ecommerce model, giants like Disney and Netflix find themselves on different footing as they rely primarily on entertainment for growth.

Like Amazon, however, both companies look to the APAC region as they formulate growth strategies. And if they aim to be successful, they need to find localization partners capable of delivering a localized experience that draws viewers in instead of repelling them.

With over 277.65 million paid memberships as of July, Netflix is still the world leader in subscription video-on-demand entertainment. And beyond its obvious interest in growing its subscriber base around the world, Netflix also is looking to Asia as a source of content production thanks to two little words: Squid Game.

The streaming giant’s most successful series of all time with 1.65 billion viewing hours in its first month and a $900 million return on a $21.4 million budget, Squid Game is the surprise hit of the decade. Now Netflix is looking to its country of origin, South Korea, in search of its next international breakout hit, according to TIME.

Indeed, 60% of Netflix subscribers have watched Korean-originating entertainment on the platform — 70% of them outside the US. And according to CNBC in 2020, “the company has also invested more than $700 million in financing partnerships and co-productions in South Korea since 2015, and the country has 3.3 million paid subscribers as of Sept. 30.”

“The ambition was to break the language barrier and really connect the global audience together,” Netflix’s APAC vice-president Minyoung Kim told TIME. “Squid Game just really proved that.”

But breaking the language barrier requires a proper investment in language services. It doesn’t matter how good a show is — if the localization is slapdash, people are far more likely to tune out. After all, what takes you out of a movie or TV show faster than typo-riddled, nonsensical subtitles or poorly executed dubbing?

According to market research firm GWI, consumption of foreign-language entertainment is on the rise, especially among younger audiences, with 76% of Gen Z and Millennial viewers watching compared to 56% among Gen X and Baby Boomers. However, poor localization quality can have a disastrous impact, with a 2022 Entertainment Globalization Association report finding that 7% of respondents quit watching entertainment once a week due to poor localization, 20% once a month, 37% once a year, and 36% never quitting.

And that’s a shame, especially when so many artists pour their hearts and souls into creating compelling art and entertainment. South Korea steadily built its reputation in global art and entertainment for decades by investing in that kind of quality. The country nurtured acclaimed artists like Kim Jee-woon, Park Chan-wook, and Bong Joon-ho, whose movie Parasite became the first foreign film to take home Best Picture at the 2020 Oscars ceremony.

“In Asia, a lot of creators are motivated to always try new things and push boundaries but are sometimes stuck because of the limitations in their own country,” Kim told TIME. “Netflix is very well positioned to connect the region together.”

Apart from South Korean, Netflix has also seen success with other Asian-originating titles like the Thai film Hunger and the Indonesian film Cigarette Girl, according to TIME.

But that’s just the beginning of Netflix’s hopes for its APAC expansion, which it views as a potential goldmine for its subscriber base. CNBC reports that’s because of its countries’ unique technological makeup with high smartphone adoption.

Netflix aims to expand throughout Asian countries by offering subscriptions at low prices compared to their more established western operations — mobile-only plans in India, Malaysia, Indonesia, the Philippines and Thailand run only $5 a month according to CNBC.

“The other thing that we did these past four years is recognizing that this region is primarily mobile first, which is a big difference from any other part of the world,” Tony Zameczkowski, vice president for business development in APAC at Netflix, told CNBC.

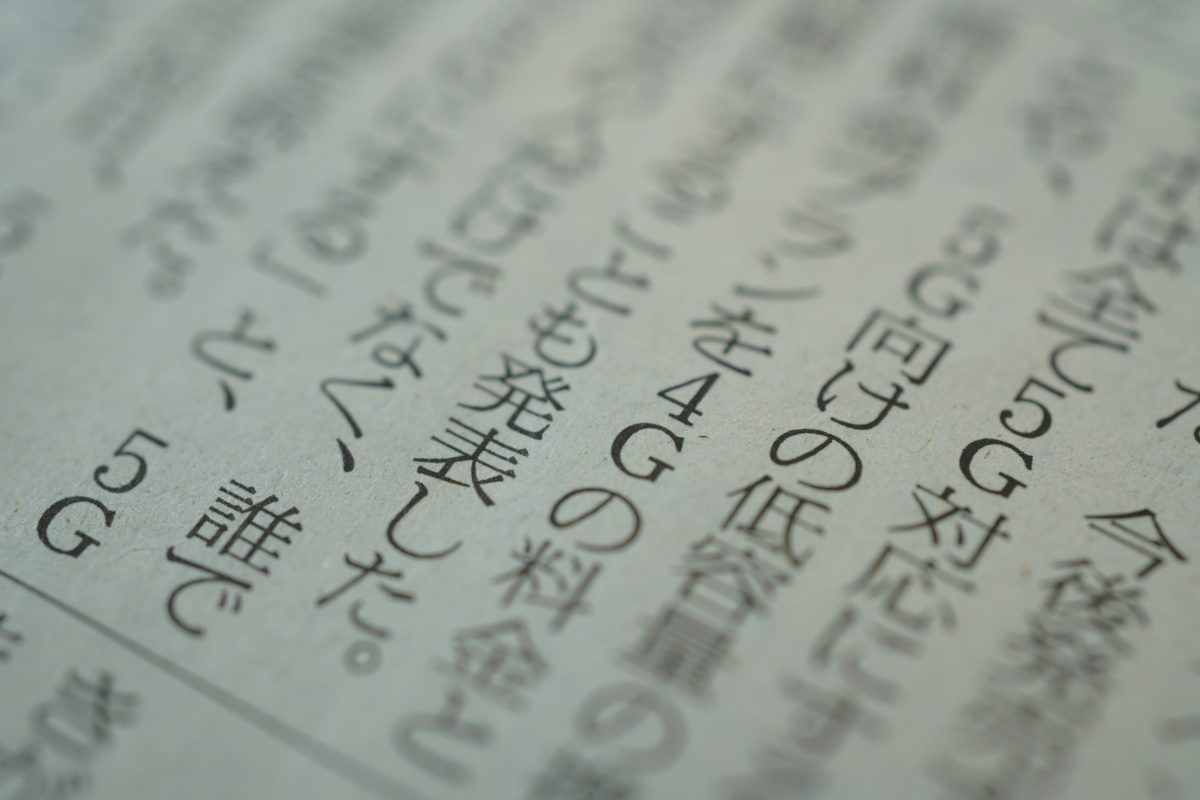

Alongside that comes an increased investment in localization efforts. The company is directing subtitling and dubbing efforts in Hindi, Malay, Korean, Japanese, Thai and Bahasa Indonesia, as well as localizing app interfaces to provide a pleasant user experience in those languages. And that’s because, as the data consistently shows, a consistent, high-quality experience in the user’s native language is essential to a successful international launch.

“If you look at APAC, we are still at the beginning of our journey and we still believe that there is a huge … opportunity there,” Zameczkowski told CNBC.

Cameron Rasmussen